Retirement, or the practice of leaving one’s job or ceasing to work after reaching a certain age, has been around since around the 18th century.Prior to the 18th century, the average life expectancy of people was between 26 and 40 years.

Compare the amount you have saved or plan to have saved for retirement compared to others from the 2013 Survey of Consumer Finances. The retirement savings include IRAs, 401ks, Thrift Savings Accounts, and pensions.

Ever wonder what the necessary retirement savings by age is? Assuming a retiree can live comfortably on $45,000 today, I’ve mapped out the necessary savings

Related Posts: How Much Should I Have Saved By Age For A Comfortable Retirement? 401k Savings Goals By Age. Recommendation To Build Wealth. Manage Your Money In One Place: Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances.

Report to the Ranking Member, Health, Education, Labor, and Pensions, RETIREMENT SECURITY Most Households Approaching Retirement Have Low Savings

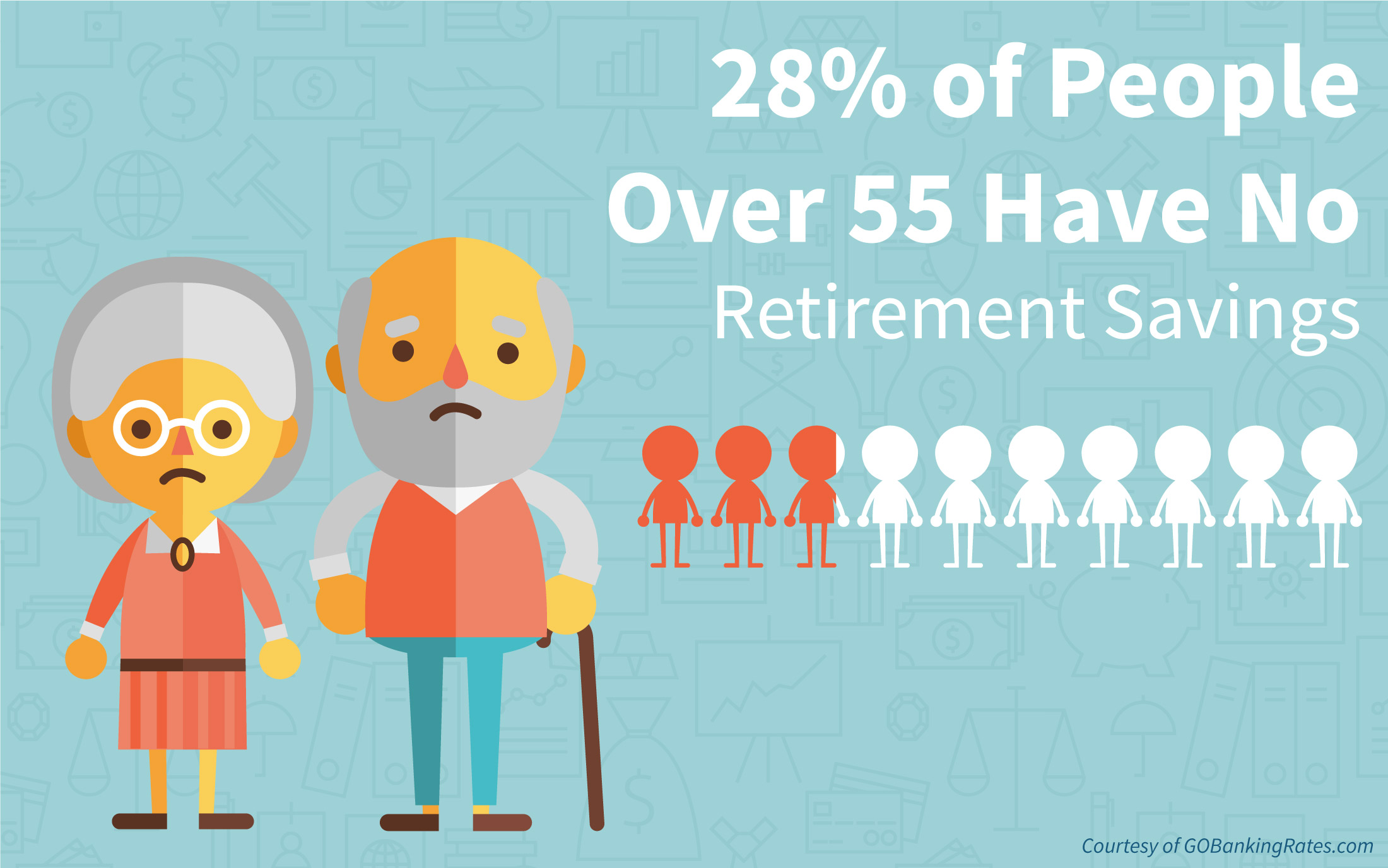

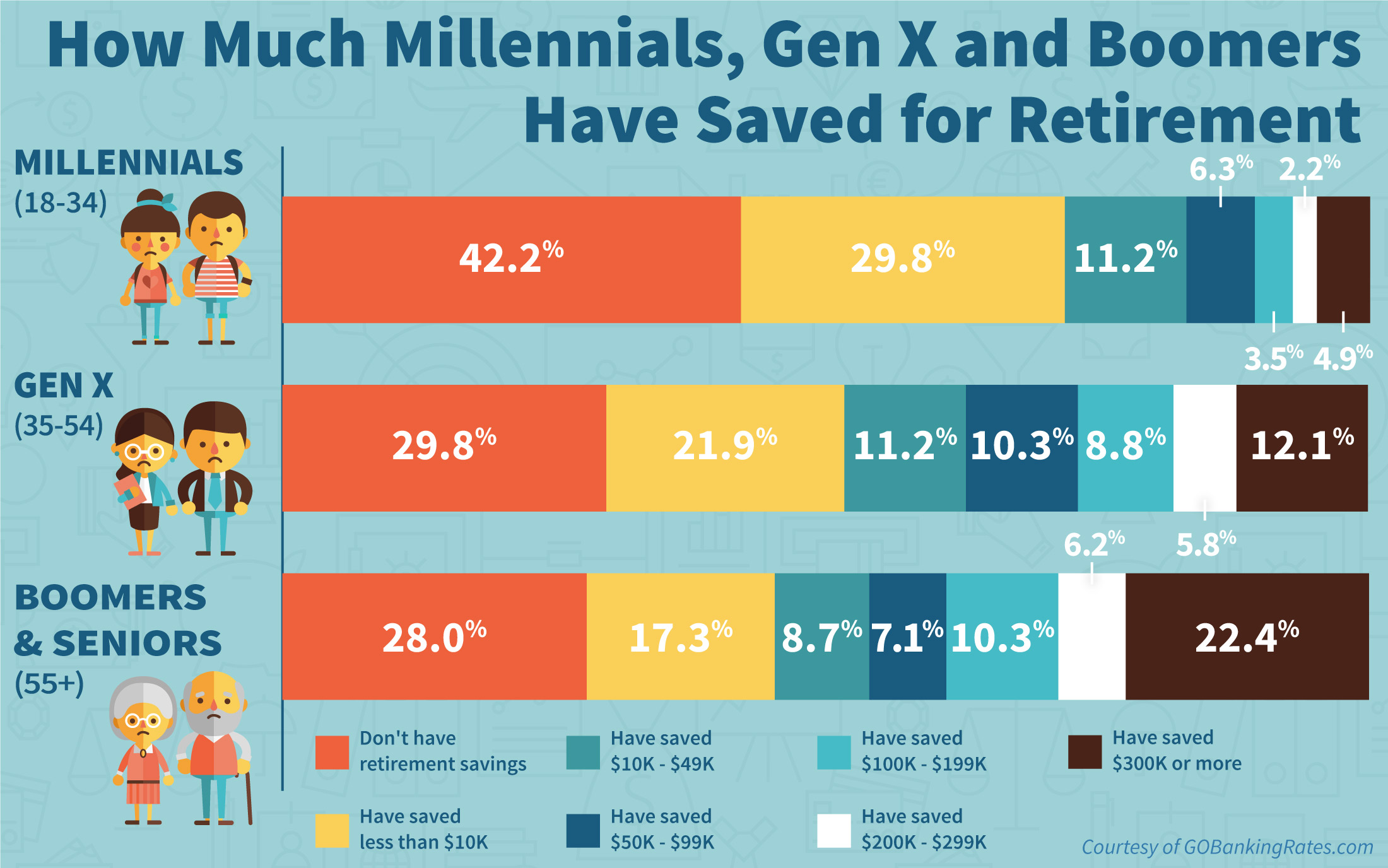

What people in various age groups have saved at present for their retirement years — and where they should be. How does your nest egg compare?

Statistics showing the average retirement savings by age are sobering. Studies have shown that people are becoming less likely to save for retirement.

A Registered Retirement Savings Plan (RRSP), or Retirement Savings Plan (RSP), is a type of Canadian account for holding savings and investment assets.RRSPs have various tax advantages compared to investing outside of tax-preferred accounts.

Saving for retirement is an important financial goal, and ideally, your nest egg should follow a steady upward trajectory over time. As you save, it can be helpful to have a benchmark for tracking your progress. For instance, you might compare your savings against the average retirement savings for

But by age, say, 45 with yearly income of $75,000, your target multiple is 3.4 times your income. In other words, your retirement savings should total $255,000 by that point.